Quick Summary

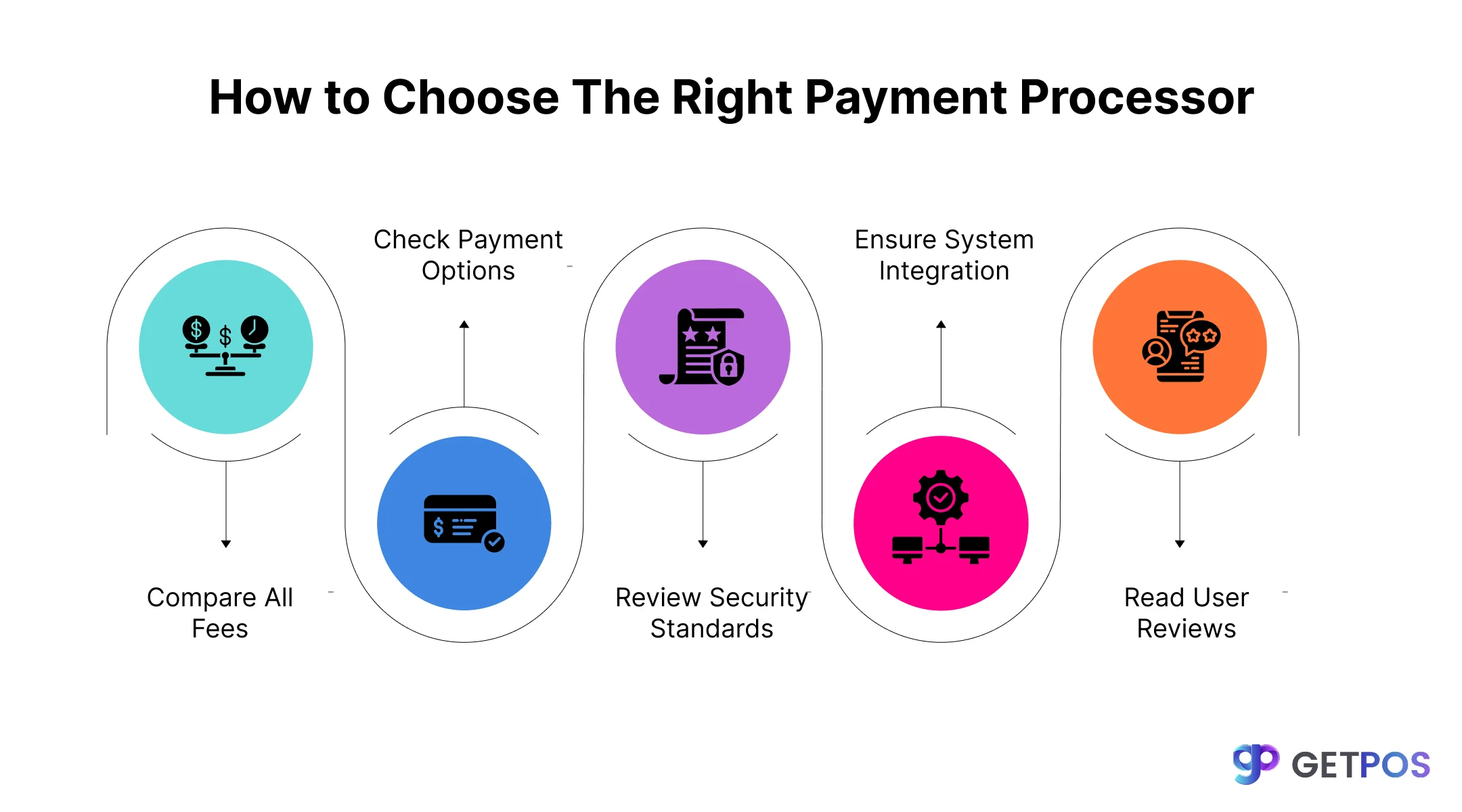

This blog explains how to choose a payment processor for any business. It covers key points like fees, security, support, and payment options to help pick the best payment processor easily.

Table Of Contents

Introduction

For any business, payments are one of the most important aspects to manage and getting them right can make a big difference. Choosing the right payment processor affects how easily customers can pay and how quickly the business gets its money. A good payment processor keeps transactions safe and helps reduce costs and errors. In this blog post, readers will learn practical steps and key points about how to choose a payment processor that fits their business needs. This guide will help make the process simple and clear to improve both sales and customer experience.

Key Takeaways

Always check fees to pick a payment processor that fits your budget and sales volume.

Make sure the payment processor supports all payment types your customers use.

Choose a payment processor that keeps payments safe with strong security rules.

Look for one that easily connects with your sales and business tools.

Pick a payment processor known for good customer help and reliable service.

1. Understand Your Business Needs First

It is best to always understand and know your business, and this is the first step when deciding on a payment processors solution. Different businesses have different needs depending on how they sell. For example, stores with physical locations need a different payment processor than online or mobile businesses.

So here, knowing your sales volume and customer payment preferences helps you pick a processor that fits well. This can improve payment speed and customer satisfaction. When you focus on your exact business model, it becomes easier to find payment options that serve you best. This approach helps you to choose a payment processor that matches your current and future needs.

2. Evaluate Pricing and Fee Structures Carefully

You can check out and evaluate the various fees that come with using payment processors before deciding, as the common fees include setup fees to start, monthly fees for service, and transaction fees charged on every sale.

Some processors also charge fees for chargebacks or currency conversion if you sell internationally. It is important to find a fee model that matches your sales volume so you do not pay too much. Also, you should watch for hidden fees that may surprise you later, and comparing fee structures carefully helps pick a processor that fits your budget and sales habits while avoiding unnecessary charges.

Here are the Things to Consider While Choosing POS System.

3. Check Supported Payment Methods & Customer Preferences

For your unique business and business needs and requirements, you should choose a payment processor that supports many different payment methods. This includes credit and debit cards, digital wallets, UPI, and Buy Now, Pay Later, etc., that are offering multiple payment options, helping customers pay in their preferred way, and can increase sales.

It is also important to consider local and regional payment methods to match customer habits and improve satisfaction, as meeting these needs makes your business more attractive and easy to shop with when considering how to choose right payment processor.

4. Security and Compliance Cannot Be Compromised

Your business needs to maintain and follow some important and required security rules to keep payment information safe. One key rule is PCI-DSS compliance. This is a standard that all businesses must meet to protect customer card data.

So when you implement a good payment processors service that uses fraud detection tools, encryption, and tokenization to keep data safe, these tools stop hackers from stealing customer information. Protecting sensitive data also protects your business reputation, and thus if data is lost or stolen, it can harm customer trust and cause legal problems.

Choose the Right POS System for Retail Business.

5. Efficient and Proper Integration With Existing Systems

The right and the best suitable payment processor that you choose should be properly compatible and connect well with your existing business systems. This means it should work smoothly with your point-of-sale system, e-commerce website, accounting software, and any ERP systems you use. And this seamless integration helps reduce extra work and mistakes, because when systems talk to each other easily, operations run much more smoothly.

So always look for flexibility and application programming interface availability, these features make it easier to connect different tools. Choosing a payment processors solution that integrates well means less hassle and more efficient daily business activities, ultimately helping you save time and resources.

6. Assess Customer Support and Reliability

For your business, this is important to note that having good customer support from your payment processor can save time and money. You need quick help through phone, chat, or email whenever issues happen, no matter the time, because a reliable support team fixes problems fast so your business keeps running smoothly.

The proper uptime and system reliability are also important because downtime means lost sales and unhappy customers, and the customer support that helps with disputes and chargebacks keeps your business safe and sound.

These are the key things to consider before using GETPOS POS.

7. Consider Scalability and Flexibility for Growth

When you plan to grow and scale your business over the years, it is important to understand that your payment processor must support your growth with scalable features. Your payment system should handle increasing transaction volumes without problems, plus pricing flexibility is also important so you can save costs as sales grow.

So you should look for features like multi-location and multi-user support, which help your business expand easily. A payment system that grows with you prevents downtime and keeps customers happy, and also helps avoid costly upgrades and supports smooth business operations as you expand.

8. Evaluate User Experience and Checkout Optimization

Your business should strive and work towards providing the best payment experience for customers. Smooth and simple payment flows help reduce cart abandonment rates, as customers do not like long or confusing checkout steps.

So here, customizable checkout options let you create a process that fits your business and customer needs better, and mobile-friendliness is very important because many customers shop on phones or tablets. Multi-language support also helps reach more people in different regions or languages, and when you focus on these areas, you improve sales and customer trust.

Choose the right Stock Management Software for Better Inventory.

9. Review Industry Reputation and Client Feedback

You can always check and confirm about the reputation/feedback/ratings of a payment processor before choosing it, by reading user reviews and case studies that shows how the processor works for other businesses. This helps avoid bad choices and problems later. Selecting trusted and proven payment processors adds safety and confidence to your business, and using a good one means the processor meets customer needs and handles payments well.

Businesses should check out the purchase order report to monitor all purchase orders and supplier deliveries. This report helps keep track of orders placed, expected delivery dates, and purchase amounts. It supports smooth supply chain operations by ensuring orders arrive on time and in the right quantity, as using this report helps maintain good inventory reports and improves store efficiency by avoiding stock shortages or delays.

Conclusion

Using the right retail reports helps businesses control inventory, improve sales, and plan better for the future. These 13 types of reports give clear facts about stock, customer buying, and sales performance, and regular use of these reports leads to smarter decisions and fewer mistakes in managing store operations. For retailers looking for a reliable solution, GETPOS offers easy-to-use tools that deliver real-time retail sales report data and efficient inventory tracking, making store management simple and effective.

Frequently Asked Questions

Look for low fees, strong security, many payment options, easy system connection, and good customer support. Pick one that fits your business size and plans to grow.

Look for processors that accept credit/debit cards, digital wallets, UPI, and local payment types. More options help satisfy customers and increase successful sales.

Payment processors usually send money in 1 to 3 business days. Some offer faster payment options but may charge extra fees.